10 Simple Techniques For Clark Wealth Partners

Table of ContentsGetting The Clark Wealth Partners To WorkMore About Clark Wealth PartnersClark Wealth Partners - TruthsClark Wealth Partners Can Be Fun For AnyoneClark Wealth Partners Things To Know Before You BuySome Known Details About Clark Wealth Partners Not known Factual Statements About Clark Wealth Partners 5 Simple Techniques For Clark Wealth Partners

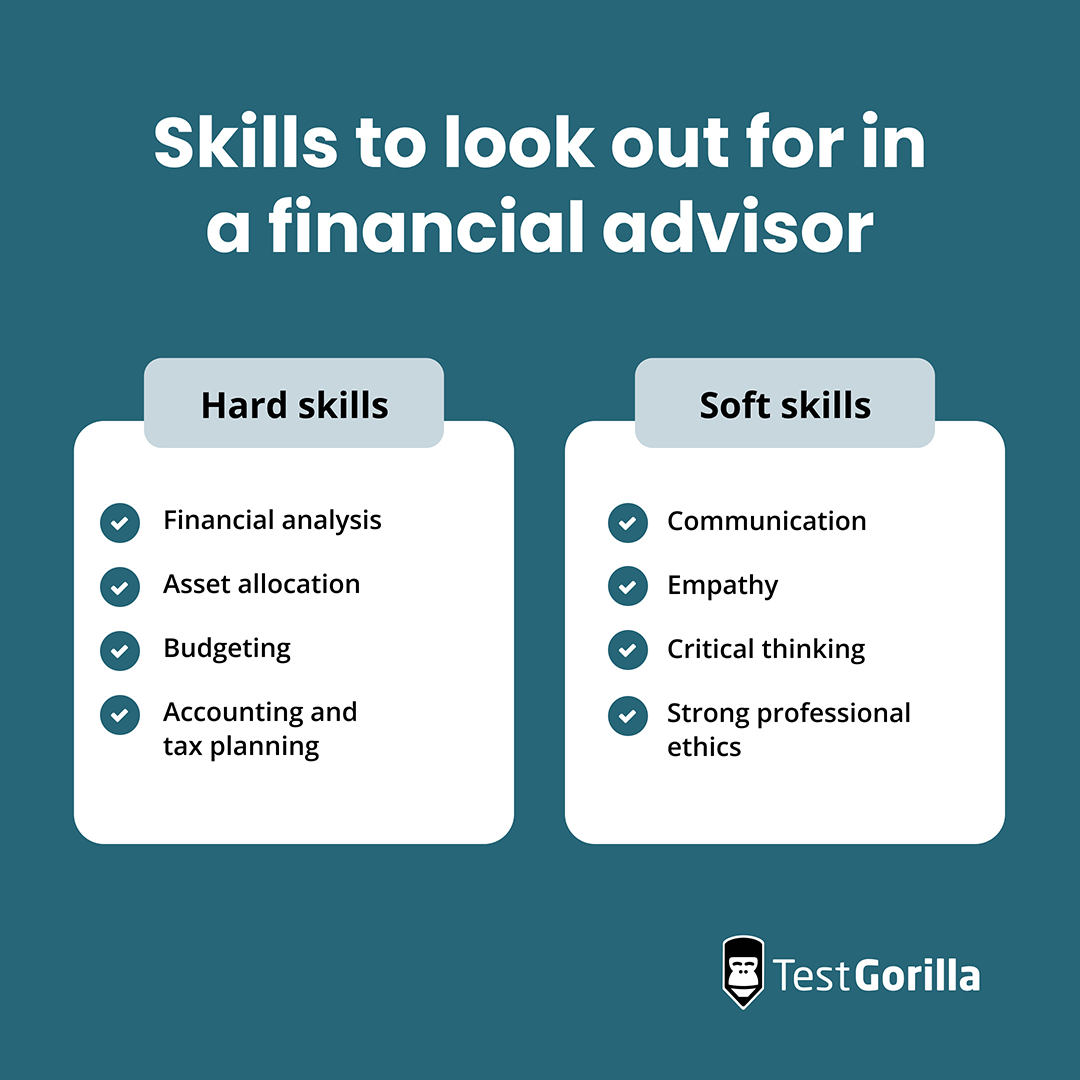

Common reasons to think about a monetary expert are: If your financial circumstance has actually ended up being a lot more complicated, or you do not have self-confidence in your money-managing abilities. Saving or navigating major life events like marriage, divorce, kids, inheritance, or job change that may substantially impact your economic situation. Navigating the change from saving for retirement to preserving riches throughout retirement and how to produce a strong retired life earnings strategy.New modern technology has brought about more thorough automated monetary devices, like robo-advisors. It's up to you to check out and figure out the appropriate fit - https://clrkwlthprtnr.creator-spring.com. Ultimately, a great monetary expert must be as mindful of your financial investments as they are with their very own, preventing excessive fees, saving cash on tax obligations, and being as clear as feasible regarding your gains and losses

The 2-Minute Rule for Clark Wealth Partners

Earning a commission on product recommendations doesn't always suggest your fee-based consultant functions versus your benefits. However they may be a lot more inclined to advise items and services on which they make a payment, which might or might not remain in your benefit. A fiduciary is lawfully bound to place their client's passions.

They might comply with a freely monitored "suitability" criterion if they're not signed up fiduciaries. This typical enables them to make suggestions for financial investments and solutions as long as they match their customer's objectives, danger tolerance, and financial scenario. This can convert to suggestions that will certainly also earn them money. On the other hand, fiduciary advisors are lawfully obligated to act in their customer's ideal passion as opposed to their own.

All About Clark Wealth Partners

ExperienceTessa reported on all points investing deep-diving into complicated monetary subjects, shedding light on lesser-known investment avenues, and revealing means readers can work the system to their advantage. As a personal financing expert in her 20s, Tessa is acutely knowledgeable about the influences time and unpredictability have on your investment choices.

.jpeg?width=386&height=338&name=6%20Money%20Decisions%20Graphic%20(R).jpeg)

It was a targeted promotion, and it worked. Find out more Review much less.

Clark Wealth Partners for Beginners

There's no solitary course to becoming one, with some individuals starting in banking or insurance coverage, while others begin in accounting. A four-year level offers a strong structure for jobs in financial investments, budgeting, and client services.

Not known Facts About Clark Wealth Partners

Common instances include the FINRA Series 7 and Collection 65 examinations for securities, or a state-issued insurance certificate for selling life or health and wellness insurance. While qualifications might not be legally required for all intending roles, employers and customers often view them as a criteria of professionalism. We check out optional credentials in the next area.

A lot of monetary organizers have 1-3 years of experience and knowledge with economic items, conformity requirements, and straight client interaction. A solid educational background is crucial, however experience demonstrates the capacity to use concept in real-world settings. Some programs integrate both, enabling you to complete coursework while making supervised hours through teaching fellowships and practicums.

More About Clark Wealth Partners

Very early years can bring lengthy hours, pressure to develop a client base, and the demand to continuously show your know-how. Financial coordinators appreciate the opportunity to work closely with clients, overview essential life choices, and typically accomplish adaptability in schedules or self-employment.

Riches supervisors can enhance their earnings with payments, property fees, and performance incentives. Economic supervisors look after a team of monetary planners and advisors, establishing departmental strategy, managing compliance, budgeting, and guiding interior operations. They spent less time on the client-facing side of the industry. Almost all financial supervisors hold a bachelor's level, and several have an MBA or comparable graduate degree.

The Basic Principles Of Clark Wealth Partners

Optional qualifications, such as the CFP, commonly need additional coursework and screening, which can extend the timeline by a number of years. According to the Bureau of Labor Stats, personal financial advisors make an average annual yearly salary of $102,140, with leading earners gaining over $239,000.

In other districts, there are policies that require them to satisfy particular demands to use the monetary expert or monetary planner titles (civilian retirement planning). What sets some economic experts apart from others are education, training, experience and certifications. There are lots of classifications for monetary experts. For economic organizers, there are 3 usual classifications: Certified, Personal and Registered Financial Coordinator.

All about Clark Wealth Partners

Those on income may have an incentive to promote the services you can find out more and products their employers provide. Where to discover a financial expert will depend upon the type of advice you require. These establishments have personnel who may help you recognize and get specific sorts of investments. For instance, term down payments, ensured investment certificates (GICs) and shared funds.